Players in the Bond Transactions

Bond investments require a number of key players to facilitate the operation of the bond. Some of these are listed below:Bond Issuers

The bond issuer is the borrower. There are many types of bond issuers:- Firms, companies

- Governments

- Supranational Entities such as International Financial Institutions

- Regions and Municipalities

- Projects and SPVs

Bookrunners, Arrangers or Underwriters

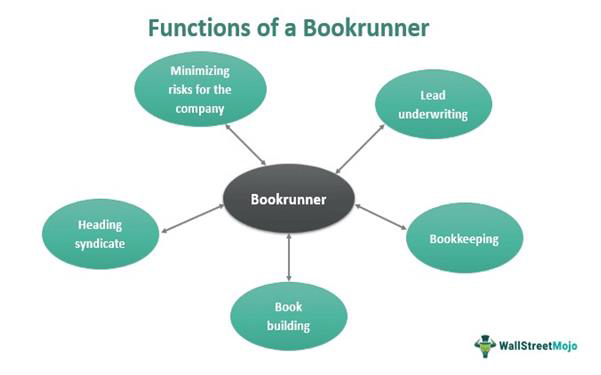

To issue a bond, a company needs a dealmaker. Often several. Banks, act as a bookrunner (also known as an arranger or underwriter), Banks advise companies issuing bonds and help take them to market the bonds. As calls for climate action and sustainable finance are getting louder, many large banks have developed net zero and/or coal exclusion policies. But in some cases these policies apply only to the investment activities of the bank, not financial services like bookrunning. Any bank supporting expansionist fossil fuel companies is driving climate chaos. The Toxic Bonds campaign asks that all banks urgently cease underwriting Toxic Bonds.

To issue a bond, a company needs a dealmaker. Often several. Banks, act as a bookrunner (also known as an arranger or underwriter), Banks advise companies issuing bonds and help take them to market the bonds. As calls for climate action and sustainable finance are getting louder, many large banks have developed net zero and/or coal exclusion policies. But in some cases these policies apply only to the investment activities of the bank, not financial services like bookrunning. Any bank supporting expansionist fossil fuel companies is driving climate chaos. The Toxic Bonds campaign asks that all banks urgently cease underwriting Toxic Bonds.

Credit ratings agencies

For a bond to be issued, the credit worthiness of the issuer needs to be rated. Just three agencies dominate this business - S&P, Moody’s and Fitch. They tell potential investors how risky a bond is. The lower they deem the risk, the cheaper and easier it becomes for companies to secure debt. Though they claim these ratings are independent, they are paid handsomely by the very same companies they rate. Despite the obvious risks - both environmental and financial - from investing in fossil fuel projects, all three agencies stress that they will not downgrade the ratings of firms with strong balance sheets based on environmental, social and governance (ESG) issues alone. It’s unsurprising, given that fossil fuel companies make up a quarter of non-financial corporate bond ratings.Investors or bondholders

The majority of bond holders are asset managers, pension funds and insurers. This shows that investors are using the public’s money – the money that we entrust them with – to fund the climate crisis. The Toxic Bonds campaign asks these bondholders to enact robust policies that exclude new investment in fossil fuel bonds and cover divestment from existing bond holdings, including passive holdings and third party assets.Primer# 1