Concept of Blue Bonds

The concept of Blue Economy has been around for almost three decades. It was fleshed up with the Ri0+20 summit in 2012, when the United Nations brought out a concept paper1 on blue economy. The core of the paper states that

Blue Economy espouses the same desired outcome as the Rio +20 Green Economy initiative namely: “improved human well-being and social equity, while significantly reducing environmental risks and ecological scarcities”2 and it endorses the same principles of low carbon, resource efficiency and social inclusion, but it is grounded in a developing world context and fashioned to reflect the circumstances and needs of countries whose future resource base is marine. Fundamental to this approach is the principle of equity ensuring that developing countries:

- Optimise the benefits received from the development of their marine environments e.g. fishery agreements, bioprospecting, oil and mineral extraction.

- Promote national equity, including gender equality, and in particular the generation of inclusive growth and decent jobs for all.

- Have their concerns and interests properly reflected in the development of seas beyond national jurisdiction; including the refinement of international governance mechanisms and their concerns as States proximate to seabed development.

Subsequently in 2014 the United Nations recognised3 and acknowledged the following;

“3. We recognise that our ocean covers three quarters of our planet, connects our populations and markets, and forms an important part of our natural and cultural heritage. It supplies nearly half the oxygen we breathe, absorbs over a quarter of the carbon dioxide we produce, plays a vital role in the water cycle and the climate system, and is an important source of our planet's biodiversity and of ecosystem services. It contributes to sustainable development and sustainable ocean-based economies, as well as to poverty eradication, food security and nutrition, maritime trade and transportation, decent work and livelihoods.

4. We are particularly alarmed by the adverse impacts of climate change on the ocean, including the rise in ocean temperatures, ocean and coastal acidification, deoxygenation, sea-level rise, the decrease in polar ice coverage, coastal erosion and extreme weather events. We acknowledge the need to address the adverse impacts that impair the crucial ability of the ocean to act as climate regulator, source of marine biodiversity, and as key provider of food and nutrition, tourism and ecosystem services, and as an engine for sustainable economic development and growth. We recognise, in this regard, the particular importance of the Paris Agreement adopted under the UN Framework Convention on Climate Change.”

The blue economy and investments in the sector have got a boost with the expansion of the idea of green economy and green finance. Debt financing through blue bonds were first initiated by Seychelles with a small 15-million-dollar issue, from international investors, demonstrating the potential for countries to harness capital markets for financing the sustainable use of marine resources. The World Bank assisted in developing the blue bond and reaching out to the three investors: Calvert Impact Capital, Nuveen, and U.S. Headquartered Prudential Financial, Inc4.

In India, the SEBI had in 2017, introduced the concept of “green debt securities” to address increasing demand for sustainable finance. The framework was revised after extensive public consultation and inclusion of views from international bodies {viz., the International Capital Market Association (ICMA) the Climate Bond Initiative and the London Stock Exchange} by aligning it with the green bond principles (GBPs) of the ICMA, which are recognised by IOSCO. The framework also introduced the concepts of (a) blue bonds (related to water management and marine sector); (b) yellow bonds (related to solar energy); and (c) transition bonds (for entities moving from carbon intensive to carbon neutral projects), as subcategories of green debt securities.5

The latest circular of SEBI defines blue bonds as “which comprise of funds raised for sustainable water management including clean water and water recycling, and sustainable maritime sector including sustainable shipping, sustainable fishing, fully traceable sustainable seafood, ocean energy and ocean mapping”.

UNEP – FI’s Principles of Blue Economy6

In 2018 launched the Principles of Blue Economy which were very laudable but its adherence in implementation could be a matter of debate and concern.

1. Protective We will support investments, activities and projects that take all possible measures to restore, protect or maintain the diversity, productivity, resilience, core functions, value and the overall health of marine ecosystems, as well as the livelihoods and communities dependent upon them.

2. Compliant We will support investments, activities and projects that are compliant with international, regional, national legal and other relevant frameworks which underpin sustainable development and ocean health.

3. Risk-aware We will endeavour to base our investment decisions on holistic and long-term assessments that account for economic, social and environmental values, quantified risks and systemic impacts and will adapt our decision-making processes and activities to reflect new knowledge of the potential risks, cumulative impacts and opportunities associated with our business activities.

4. Systemic We will endeavour to identify the systemic and cumulative impacts of our investments, activities and projects across value chains.

5. Inclusive We will support investments, activities and projects that include, support and enhance local livelihoods, and engage effectively with relevant stakeholders, identifying, responding to, and mitigating any issues arising from affected parties.

6. Cooperative We will cooperate with other financial institutions and relevant stakeholders to promote and implement these principles through sharing of knowledge about the ocean, best practices for a sustainable Blue Economy, lessons learned, perspectives and ideas.

7. Transparent We will make information available on our investment / banking / insurance actives and projects and their social, environmental and economic impacts (positive and negative), with due respect to confidentiality. We will endeavour to report on progress in terms of implementation of these Principles.

8. Purposeful We will endeavour to direct investment / banking / insurance to projects and activities that contribute directly to the achievement of Sustainable Development Goal 14 (“Conserve and sustainably use the oceans, seas and marine resources for sustainable development”) and other Sustainable Development Goals especially those which contribute to good governance of the ocean.

9. Impactful We will support investments, projects and activities that go beyond the avoidance of harm to provide social, environmental and economic benefits from our ocean for both current and future generations.

10. Precautionary We will support investments, activities and projects in our ocean that have assessed the environmental and social risks and impacts of their activities based on sound scientific evidence. The precautionary principle will prevail, especially when scientific data is not available.

11. Diversified Recognising the importance of small to medium enterprises in the Blue Economy, we will endeavour to diversify our investment / banking / insurance instruments to reach a wider range of sustainable development projects, for example in traditional and non-traditional maritime sectors, and in small and large-scale projects.

12. Solution-driven We will endeavour to direct investment / banking / insurance to innovative commercial solutions to maritime issues (both land- and ocean-based), that have a positive impact on marine ecosystems and ocean-dependent livelihoods. We will work to identify and to foster the business case for such projects, and to encourage the spread of best practice thus developed.

13. Partnering We will partner with public, private and nongovernment sector entities to accelerate progress towards a sustainable Blue Economy, including in the establishment and implementation of coastal and maritime spatial planning approaches.

14. Science-led We will actively seek to develop knowledge and data on the potential risks and impacts associated with our investment / banking / insurance activities, as well as encouraging sustainable finance opportunities in the Blue Economy. More broadly, we will endeavour to share scientific information and data on the marine environment.

Blue Bond Investments

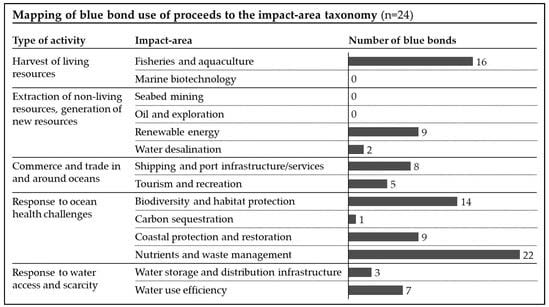

Between 2018 and 2022, 26 blue bond transactions took place, amounting to a total value of USD 5.0 billion, with a 92% CAGR between those years. Currently, blue bonds represent less than 0.5% of the sustainable debt market. The use of proceeds has mostly focused on waste management, biodiversity, and sustainable fisheries, but also ranges across other areas of the sustainable blue economy. Only two-thirds of blue bond issuers report on impact metrics, providing further opportunity to add detail and rigor.

Researchers have found that investing USD 2–4 trillion in sustainable oceans could yield net benefits of USD 8–23T over the next 30 years across four ocean transformations, namely “conservation and restoration of mangroves, decarbonization of international shipping, sustainable ocean-based food production, [and] offshore wind energy production” This implies benefit–cost ratios of between 3:1 and 12:1. Other blue economy industries such as tourism and recreation, coastal protection and conservation, and marine-oriented science sectors also offer benefits7.

When one sees the use of blue bond proceeds so far, certain types of investments will inherently be in contradiction to the UNEP-FI principles eg Seabed mining, Oil Exploration and Production. Certain others also have the risk of bringing damage to the ecosystems and local environments. While the idea of partnership and collaboration is absolutely essential as oceans are global commons, private sector participation is likely to bring more competitive use of the resources than a collaborative venture to meet the UN SDGs. The UNEP-FI brought out a comprehensive list of exclusions from blue economy financing8.

National Exclusion List Needed India specifically needs an exclusion list so that fossil fuel industry, deep sea mining, large scale modification of the coast line through various infrastructure projects are kept away from such financial instruments. Ideally the blue bonds must be raised and invested in sustainable community-based fisheries and tourism.